All about Pacific Prime

Insurance coverage likewise assists cover expenses associated with responsibility (legal obligation) for damages or injury caused to a 3rd celebration. Insurance is an agreement (policy) in which an insurer compensates one more versus losses from certain backups or dangers.

Investopedia/ Daniel Fishel Several insurance plan kinds are readily available, and essentially any type of specific or business can find an insurance policy company willing to insure themfor a rate. Most individuals in the United States have at least one of these types of insurance coverage, and car insurance coverage is required by state legislation.

Everything about Pacific Prime

So finding the cost that is right for you needs some research. The policy limitation is the maximum amount an insurance firm will certainly spend for a protected loss under a policy. Maximums might be established per period (e.g., yearly or plan term), per loss or injury, or over the life of the policy, additionally referred to as the life time maximum.

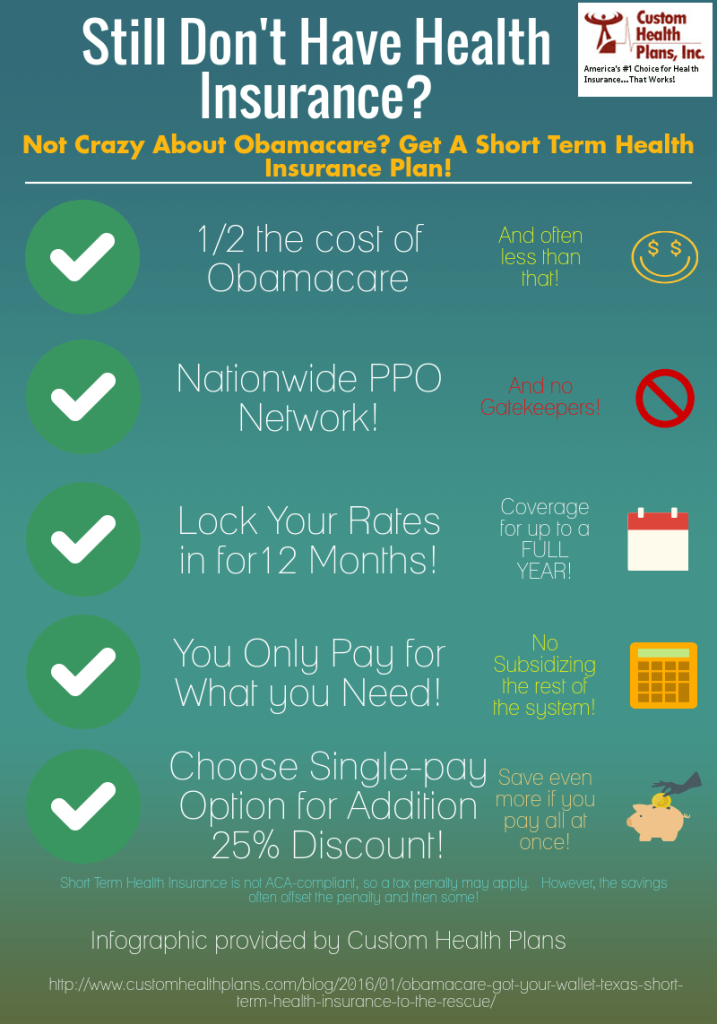

There are numerous various kinds of insurance policy. Health insurance policy helps covers regular and emergency situation medical treatment expenses, frequently with the option to add vision and oral solutions separately.

However, many preventive services may be covered for complimentary before these are met. Health and wellness insurance policy may be bought from an insurer, an insurance policy agent, the government Medical insurance Marketplace, provided by a company, or federal Medicare and Medicaid insurance coverage. The federal government no more requires Americans to have health and wellness insurance policy, yet in some states, such as California, you might pay a tax charge if you don't have insurance coverage.

Some Known Questions About Pacific Prime.

The business after that pays all or many of the protected costs linked with an automobile mishap or various other lorry damage. If you have actually a leased lorry or borrowed cash to get an automobile, your lending institution or renting dealer will likely need you to lug auto insurance coverage.

A life insurance policy assurances that the insurance firm pays a sum of cash to your recipients (such as a spouse or kids) if you die. There are 2 primary types of life insurance policy.

Insurance is a method to handle your financial risks. When you get insurance, you purchase defense against unexpected monetary losses.

7 Simple Techniques For Pacific Prime

Although there are several insurance coverage kinds, a few of one of the most common are life, health, property owners, and automobile. The right sort of insurance coverage for you will depend on your goals and economic circumstance.

Have you ever before had a moment while looking at your insurance coverage policy or buying for insurance when you've thought, "What is insurance? Insurance policy can informative post be a mystical and confusing thing. Exactly how does insurance coverage job?

Enduring a loss without insurance coverage can place you in a challenging monetary scenario. Insurance policy is a crucial economic tool.

Pacific Prime - Questions

And in some situations, like auto insurance policy and employees' compensation, you may be required by law to have insurance in order to protect others - group insurance plans. Find out about ourInsurance options Insurance policy is basically an enormous nest egg shared by many individuals (called policyholders) and taken care of by an insurance policy provider. The insurance business uses cash accumulated (called costs) from its insurance holders and various other investments to spend for its operations and to fulfill its promise to insurance policy holders when they submit an insurance claim